Financial Challenges as a New Entrepreneur and CEO

Starting and running your own business is an exciting yet demanding journey. While new CEOs and entrepreneurs often launch with passion and confidence, they inevitably face challenges beyond their core expertise—especially in financial management. Even the most skilled business leaders can struggle with areas like cash flow planning, investor management, and financial forecasting, which are critical for long-term success.

Increased Activity in the Startup Ecosystem

In recent years, there has been a notable surge in startup activity globally. This growth is driven by initiatives promoting entrepreneurship and an overall cultural shift towards innovation. For example:

- The Global Startup Ecosystem Report 2023 analyzed over 3.5 million startups across 290 ecosystems, showing resilience despite economic uncertainties. Global startup ecosystem report

- Emerging startup ecosystems are capturing a larger share of Series A funding, with their portion increasing from 13% in 2019 to 19% in 2023. State of the Global Startup Economy

This growth reflects a promising environment for innovation, supported by education programs, inclusion initiatives, and policies that nurture entrepreneurial talent. In the past few years there has been an increased in the entrepreneural startups in the UK.

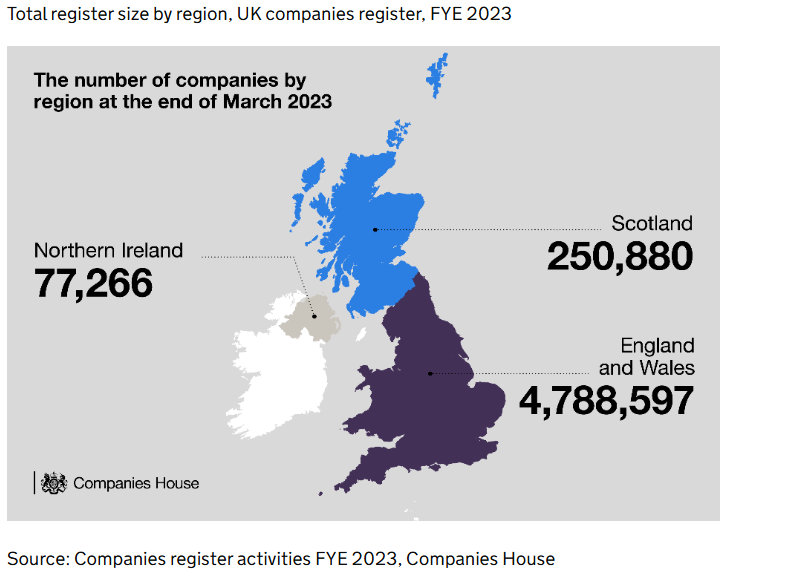

The number of companies on the total register reached 5,116,743 by the end of March 2023

While the rise in startups is encouraging, not all succeed in the long term. Failure rates remain high due to several factors.

The Reality of Business Failures

Every year, thousands of businesses are launched in the UK. In FY 2023 alone, over 800,000 new companies were registered. However, nearly 50% of startups fail within their first three years, with poor financial management being one of the key reasons. Many CEOs, after receiving funding, tend to spend aggressively without robust financial planning—leading to cash shortages and premature failure.

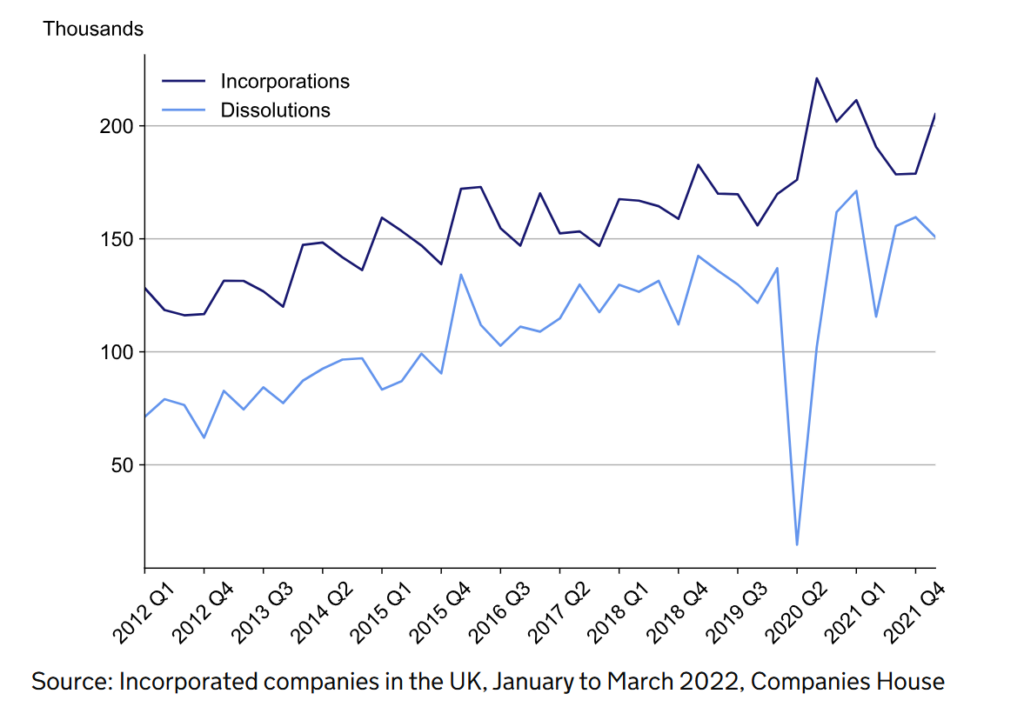

UK total incorporations and dissolutions, 2012 quarter 1 to 2022 quarter 1

While the increase in business dissolutions due to events like COVID-19 pandemic, in many cases are, unavoidable, there are numerous other factors that contribute to business failures.

Common Financial pitfalls that Undermine Startups

- Cash Flow Mismanagement: Research carried out by ZIPPIA revealed that 82% of small businesses in the US fail due to cash flow issues, often caused by poor forecasting or delayed receivables. Cash flow analysis is a crucial tool for understanding your business’s financial health, helping you manage liquidity, identify potential issues early, and make informed decisions. Yet, many new entrepreneurs overlook its importance.

- Burn rate paradox: While rapid spending might seem necessary for growth, it can paradoxically slow down your startup’s momentum. A high burn rate can shorten your financial runway, compromise decision-making, erode investor confidence, and limit your ability to adapt to market change.

- Lack of rigorous Scenario analysis: Lack of rigorous scenario analysis is a significant pitfall for new CEOs and entrepreneurs. This oversight can leave businesses vulnerable to unexpected market shifts and economic changes. Many leaders focus solely on optimistic projections, neglecting to consider potential downturns or challenges.

Effective scenario planning involves exploring multiple future outcomes, from best-case to worst-case scenarios.

Staying Objective and Building a Support Network

Remember, you’ve overcome numerous obstacles to reach this stage. Don’t let avoidable mistakes derail your dreams. Stay objective and disciplined, make informed choices, and don’t hesitate to seek expert guidance. Surrounding yourself with advisors who challenge your decisions helps prevent costly mistakes. Regular financial reviews and scenario planning ensure you make data-driven, strategic choices.

Empowering Your Business Journey

At Ruddham Consulting, we’re here to support you on this journey. We offer tailored services to educate new businesses about financial management, maintain investor relationships, and even assist in capital raising. Our team can assess your current business, work on projections, and help you navigate the complex world of startup finances.

Ready to take your business to the next level? Book a call with us today and let’s discuss how we can help you overcome these challenges and achieve your entrepreneurial dreams.

📩 Contact Us: info@ruddhamconsulting.com, 📞 +442034321820

🚀 Empowering Growth Through Strategic Insights and Financial Acumen.