In-House vs Third-Party Accounting Software: What UK Companies Need to Know

If your company has developed its own in-house software, there is no legal requirement to use specific UK accounting software to remain compliant. However, several key considerations must be addressed to ensure compliance with HMRC and Companies House regulations.

1. Making Tax Digital (MTD) Requirements

HMRC’s Making Tax Digital (MTD) initiative requires businesses to keep digital records and submit tax returns using compatible software. In-house software can be used for MTD submissions, provided it meets HMRC’s technical specifications and is authorized for use.

If your internal system is not MTD-compatible, you may need to adopt third-party solutions such as Xero, QuickBooks, or Sage.

You can view HMRC’s list of MTD-compatible software here

2. Companies House Filing

Companies House permits statutory accounts, confirmation statements, and other filings to be submitted using either manual processes or software solutions. If your in-house software supports XML-based submissions and complies with Companies House technical standards, it can be used for digital filing.

However, the direction of travel is towards mandatory software filing, as set out in the Economic Crime and Corporate Transparency Act. Filing via software will soon be required, and other notable changes include:

- Small companies will need to file profit and loss accounts, and

- The option to submit abridged accounts will be removed.

Third-party software can simplify these changes by automating submissions and reducing the risk of errors.

3. Payroll Compliance

If you’re managing payroll in-house, the software must be properly configured to align with HMRC requirements. This includes accurate real-time reporting of wages, PAYE, and National Insurance contributions. Provided your internal system is compliant, there’s no obligation to use third-party payroll software.

4. Accuracy and Automation

Third-party accounting solutions such as Xero offer features like real-time dashboards, automated tax calculations, and compliance tracking. While not mandatory, these tools can greatly reduce human error and administrative workload—especially useful for companies with growing transaction volumes or limited finance teams.

5. Cost and Scalability

In some cases, third-party tools may be more cost-effective and scalable, particularly for companies handling complex filings or multi-entity accounts. They often provide benefits such as:

- Integration with bank feeds

- Automated alerts for deadlines

- Multi-user access and audit trails

Choosing Between In-House and Third-Party Software

Ultimately, companies have two options:

a) Use HMRC- and Companies House-approved third-party software, or

b) Ensure in-house systems meet the relevant compliance requirements.

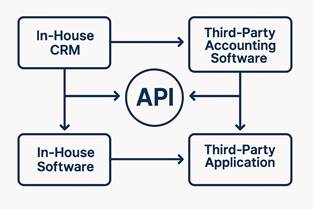

If you choose to continue using your own software for internal records but rely on third-party tools for official submissions, seamless integration between systems becomes essential. Manual data imports can be inefficient and error-prone. Instead, consider building an API connection between your in-house software and third-party platforms for more efficient, compliant data transfer.

You may also choose to continue using your in-house software, provided it meets all relevant compliance requirements.

Whichever route you take, it’s advisable to begin the assessment process early. This helps avoid last-minute decisions and ensures your systems are ready and well ahead of any regulatory deadlines.

Conclusion

Yes, your business can use its own in-house software for tax and company filings—provided it meets the legal and technical standards set by HMRC and Companies House. However, using approved accounting platforms may provide advantages such as automation, time savings, and greater reliability.

The right approach depends on your company’s operational needs, technical capabilities, and long-term strategy.

How We Can Help

Every business is different—there’s no one-size-fits-all solution. At Ruddham Consulting, we help you evaluate your options and guide you toward the best-fit system for your current setup and future growth. Whether you’re building a compliant in-house platform or integrating third-party tools, we’ll support you in achieving maximum efficiency with minimal effort.

Useful Links

- Companies House blog: Changes to Accounts

- Technical interface specifications for Companies House software

- HMRC: Making Tax Digital for Income Tax

- Create tax software and apps using HMRC APIs